What it means: the purchaser of the choice could wait until the price goes to $20,000, if they’ll stomach it, and purchase in at $10,000 at that point, an apparent bargain; or if the value sinks beneath $10,000 and by no means returns in 2018, they could select not to train the choice (in contrast to a futures swap, there’s no obligation to purchase) and would lose only their $2,250 charge. The corporate obtained CFTC (Commodity Futures Trading Commission) approval in July after a 3-year effort, and in mid-November it matched an choice for bitcoin at $10,000 that is good via the top of 2018.The option carried a fee of $2,250. Almost certainly not. Great Free Bitcoin information about buying and selling is plentiful out there, so why not be taught from that? Plus, TodayNFTNews has a particular category that is devoted solely to itemizing ICOs, NFTs, and airdrop calendars free of value. Binance however also announced that it was listing the meme coin in its innovation zone.

What it means: the purchaser of the choice could wait until the price goes to $20,000, if they’ll stomach it, and purchase in at $10,000 at that point, an apparent bargain; or if the value sinks beneath $10,000 and by no means returns in 2018, they could select not to train the choice (in contrast to a futures swap, there’s no obligation to purchase) and would lose only their $2,250 charge. The corporate obtained CFTC (Commodity Futures Trading Commission) approval in July after a 3-year effort, and in mid-November it matched an choice for bitcoin at $10,000 that is good via the top of 2018.The option carried a fee of $2,250. Almost certainly not. Great Free Bitcoin information about buying and selling is plentiful out there, so why not be taught from that? Plus, TodayNFTNews has a particular category that is devoted solely to itemizing ICOs, NFTs, and airdrop calendars free of value. Binance however also announced that it was listing the meme coin in its innovation zone.

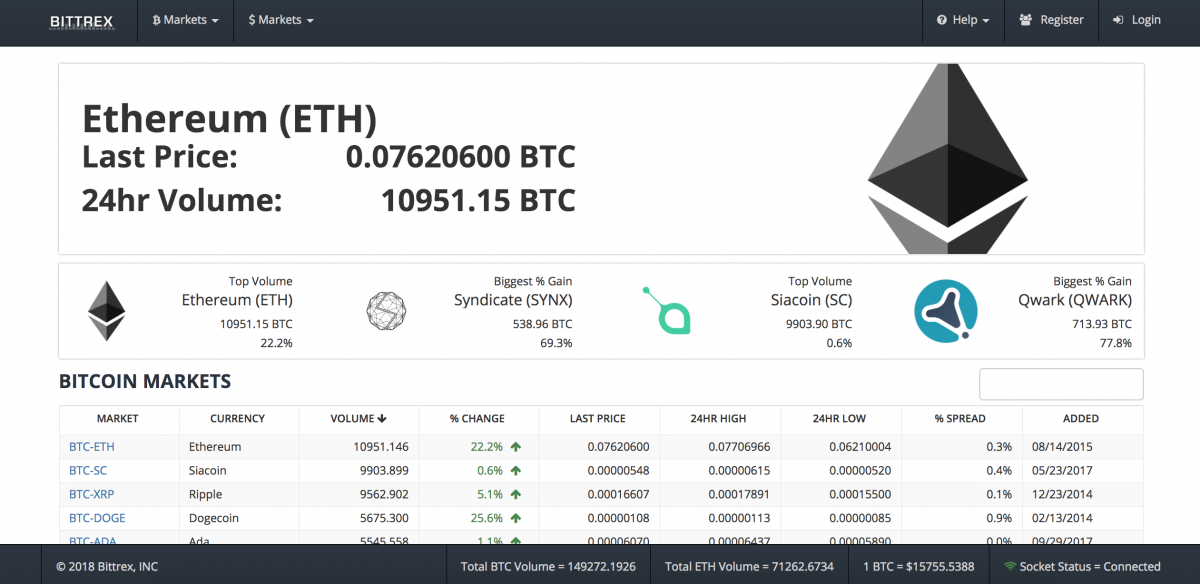

And Ethereum is to thank (or blame) for the explosion in “initial coin offerings” (ICOs), after its own outstanding token sale in 2014, when it raised $18 million worth of bitcoin, que crypto comprar hoy allowing it to mine the “genesis block” of the Ethereum network.

And Ethereum is to thank (or blame) for the explosion in “initial coin offerings” (ICOs), after its own outstanding token sale in 2014, when it raised $18 million worth of bitcoin, que crypto comprar hoy allowing it to mine the “genesis block” of the Ethereum network.

Unlike bitcoin, which has a mysterious, nameless creator in Satoshi Nakamoto, litecoin’s creator is public and well-preferred. Just two years after Nasdaq purchased his company SecondMarket, which allowed for the buying and selling of inventory in personal companies (like Facebook earlier than it went public), Barry Silbert has develop into the only greatest identify in cryptocurrency startup investing, bar none. Dorsey is a compelling determine in tech, at the moment the CEO of each Square and Twitter, and he’s using both firms to indicate his interest in crypto.

This year, Ravikant went past simply investing in cryptocurrency corporations: he’s now serving to build and run two of his own. “To me he’s No. 1 on any list,” says Nick Tomaino, normal associate at 1confirmation, a crypto investment fund.

But those different companies didn’t get a $2 million funding this 12 months from Alan Patricof, founder and managing companion of Greycroft Ventures and one of the world’s most influential venture capitalists.

The soaring adoption price BitPesa is seeing, Rossiello says, “is uncorrelated to the bitcoin price, slightly it’s steady adoption by corporations working with startups for modern solutions that resolve real issues in rising markets.” Rossiello and BitPesa are starting out in Africa, however proving out a model that has main world implications. Some attribute the soaring bitcoin value hike of the previous month to the CME Group news greater than any other single factor.

Juthica Chou of LedgerX (see No. 3), when requested about CME Group’s plans, says: “It’s my private view that the bitcoin markets should not fairly developed enough” for cash-settled futures. “It’s exciting to see the next wave of mainstream tech firms construct crypto products,” says Dan Held, who offered his crypto app ZeroBlock to Blockchain in 2013 and now runs business improvement for Picks & Shovels, which presents portfolio administration to crypto hedge funds.